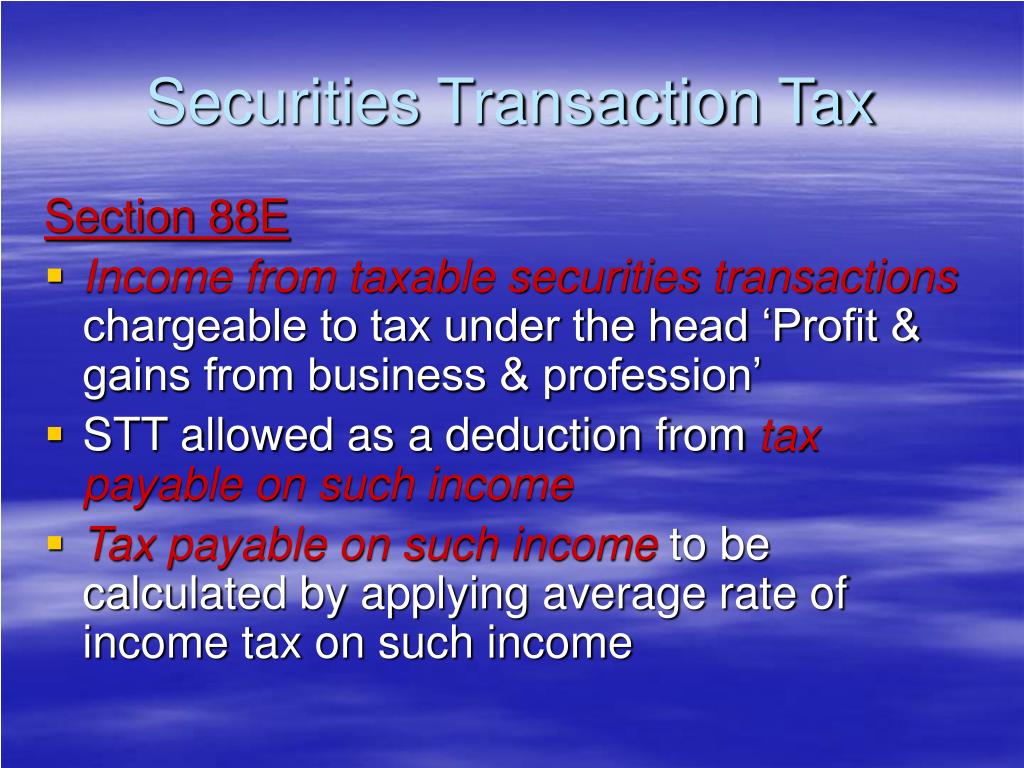

It would be imposed on transactions that occurred within the United States and on transactions that took place outside the country and involved at least one U.S. The tax would not apply to the initial issuance of stock or debt securities, transactions of debt obligations with fixed maturities of no more than 100 days, or currency transactions (although transactions involving currency derivatives would be taxed). In 2013, 11 countries in the EU's Eurozone established the European Union financial transaction tax, estimated to generate 35 billion per year. For purchases of derivatives, the tax would be 0.01 percent of all payments made under the terms of the contract, including the price paid when the contract was written, any periodic payments, and any amount paid when the contract expired. For purchases of stocks, bonds, and other debt obligations, the tax generally would be 0.01 percent of the value of the security. This option would impose a tax on the purchase of most securities and on transactions involving derivatives (contracts requiring one or more payments that are calculated by reference to the change in an observable variable). While the various countries adopting financial transaction taxes will uniquely define which securities transactions will trigger the tax and the amount of. However, the Securities and Exchange Commission charges a fee of approximately 0.002 percent on most transactions. Several G 20 countries already use financial transactions taxes (for example, the 0.5 percent stamp duty on locally-registered share in the UK). Under current federal tax law, no tax is imposed on the purchase of securities (stocks and bonds) or other financial products.

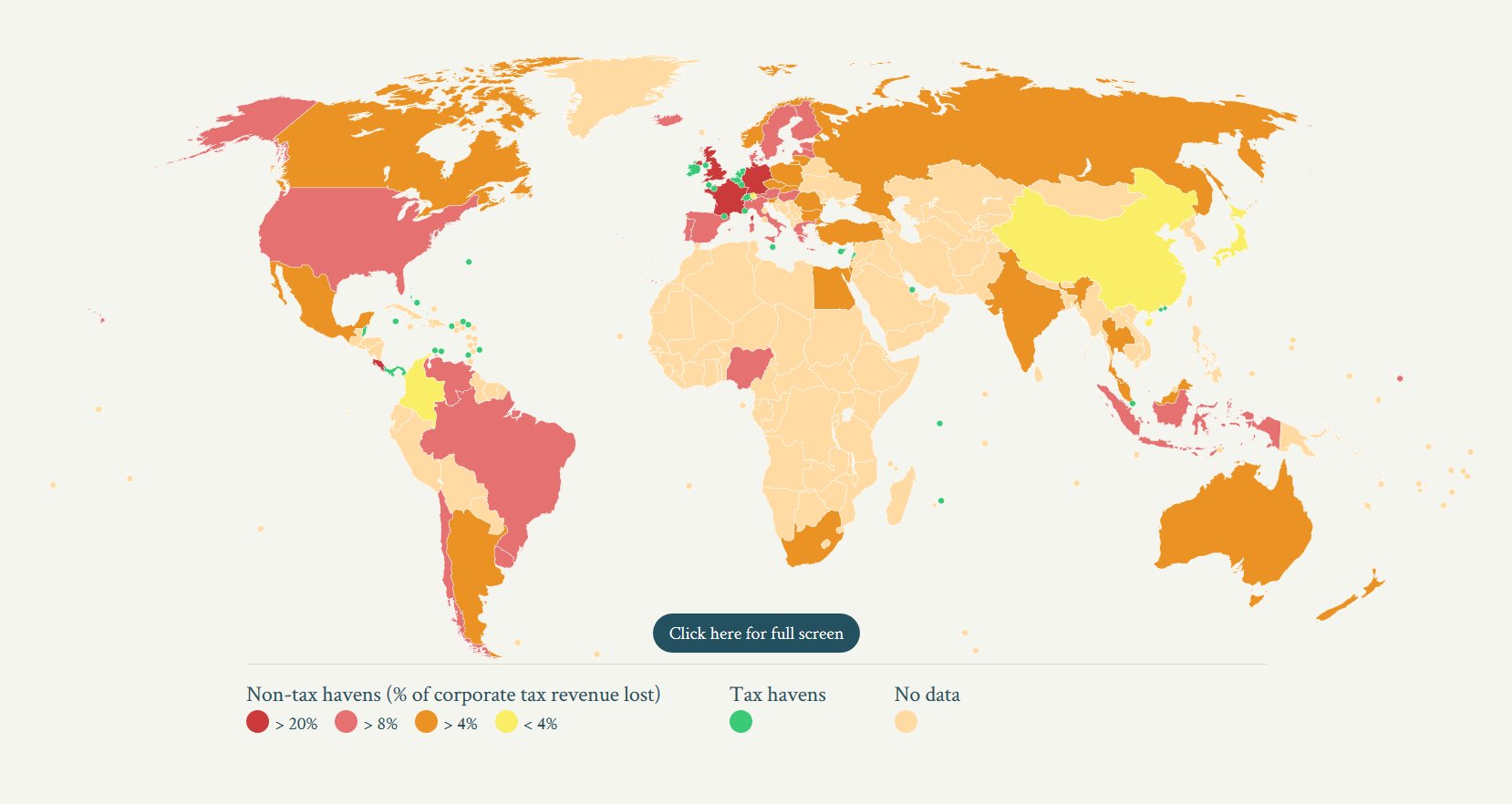

The United States is home to large financial markets with high volumes of trading. Specify the taxation country on the transaction to identify the country in which the transaction is deemed to have taken place for taxation purposes.

0 kommentar(er)

0 kommentar(er)